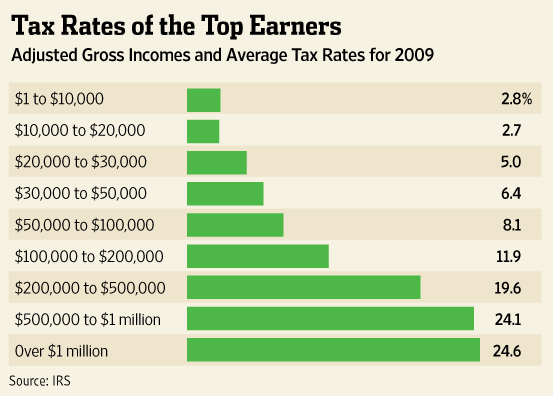

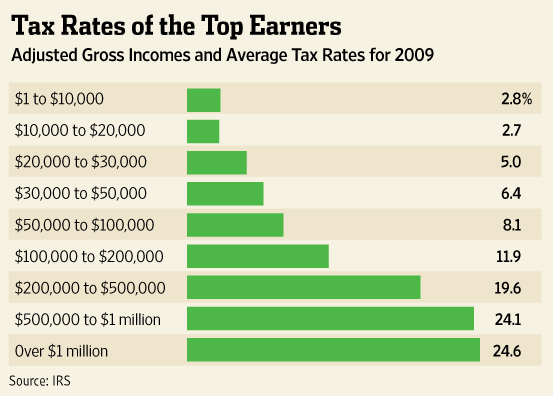

perhaps a picture makes it easier to understand

Not that it will matter but it only enforces the explanation that the left choose to be ignorant.

Not that it will matter but it only enforces the explanation that the left choose to be ignorant.