Openmind

Well-Known Member

New CBO Report Reaffirms the Growth of Income Inequality in AmericaBy Phil Scarr On October 25, 2011 The Congressional Budget Office just released a report which shows yet again the growth of inequality in America. We have become a class-based society.

For the 1 percent of the population with the highest income, average real after-tax household income grew by 275 percent between 1979 and 2007 (see Summary Figure 1).

•For others in the 20 percent of the population with the highest income (those in the 81st through 99th percentiles), average real after-tax household income grew by 65 percent over that period, much faster than it did for the remaining 80 percent of the population, but not nearly as fast as for the top 1 percent.

•For the 60 percent of the population in the middle of the income scale (the 21st through 80th percentiles), the growth in average real after-tax household income was just under 40 percent.

•For the 20 percent of the population with the lowest income, average real after-tax household income was about 18 percent higher in 2007 than it had been in 1979.

As a result of that uneven income growth, the distribution of after-tax household income in the United States was substantially more unequal in 2007 than in 1979: The share of income accruing to higher-income households increased, whereas the share accruing to other households declined. In fact, between 2005 and 2007, the after-tax income received by the 20 percent of the population with the highest income exceeded the aftertax income of the remaining 80 percent.

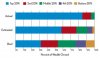

What’s really depressing about this is that American’s don’t understand how unequal America has become. A study by Michael Norton surveyed Americans on the question of what they think inequality is and what they think it should be. His results were startling.

Notice the variation between Ideal and Actual. And the startling line that shows how deluded Americans are as to the real distribution of wealth in the nation.

I challenge anyone to argue that this level of inequality is a good thing for America.

For the 1 percent of the population with the highest income, average real after-tax household income grew by 275 percent between 1979 and 2007 (see Summary Figure 1).

•For others in the 20 percent of the population with the highest income (those in the 81st through 99th percentiles), average real after-tax household income grew by 65 percent over that period, much faster than it did for the remaining 80 percent of the population, but not nearly as fast as for the top 1 percent.

•For the 60 percent of the population in the middle of the income scale (the 21st through 80th percentiles), the growth in average real after-tax household income was just under 40 percent.

•For the 20 percent of the population with the lowest income, average real after-tax household income was about 18 percent higher in 2007 than it had been in 1979.

As a result of that uneven income growth, the distribution of after-tax household income in the United States was substantially more unequal in 2007 than in 1979: The share of income accruing to higher-income households increased, whereas the share accruing to other households declined. In fact, between 2005 and 2007, the after-tax income received by the 20 percent of the population with the highest income exceeded the aftertax income of the remaining 80 percent.

What’s really depressing about this is that American’s don’t understand how unequal America has become. A study by Michael Norton surveyed Americans on the question of what they think inequality is and what they think it should be. His results were startling.

Notice the variation between Ideal and Actual. And the startling line that shows how deluded Americans are as to the real distribution of wealth in the nation.

I challenge anyone to argue that this level of inequality is a good thing for America.